U.S. industrial conglomerate 3M Co. on Tuesday beat Wall Street expectations for first-quarter profit on cost cutting, sending its shares up 7% even as it warned of a potential hit to 2025 earnings from trade tensions.

Bill Brown, who succeeded Mike Roman as CEO in May, laid out a restructuring plan in July focused on reining in spending and redirecting funds from mitigating legal liabilities.

In February, 3M said it was targeting an operating margin of about 25% by 2025. In the first quarter, adjusted operating income margin was 23.5%, up 220 basis points.

BIG BANK CEOS WEIGH IN ON TRUMP’S TARIFFS: ‘CONSIDERABLE TURBULENCE’

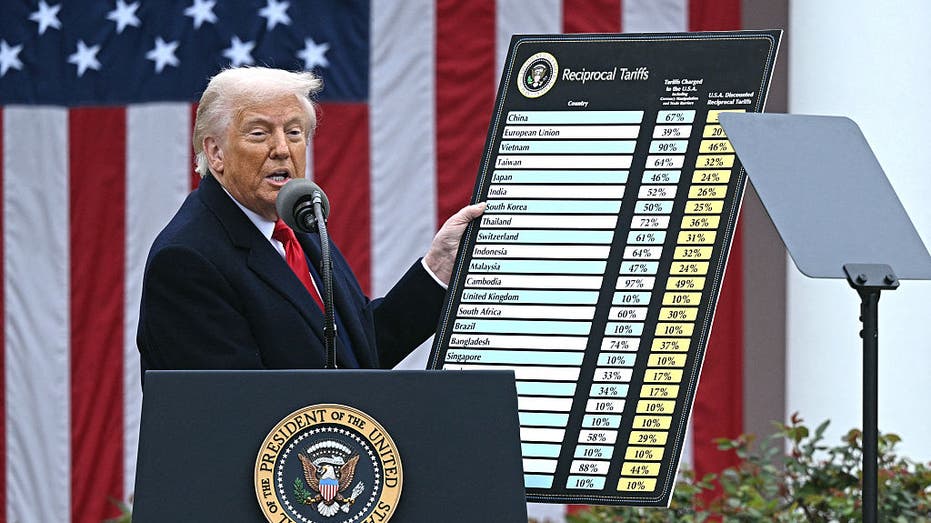

Minnesota-based 3M now expects a potential tariff-related hit of 20 cents to 40 cents per share on its 2025 adjusted profit forecast of $7.60 to $7.90, keeping in view heightening global trade tensions.

U.S. President Donald Trump’s tariffs have fueled concerns about an economic slowdown and a decline in consumer sentiment, which could impact sales for 3M’s consumer products, including its iconic Scotch tape and Post-it notes. China accounted for roughly 10% of the company’s global revenue, as of March.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MMM | 3M CO. | 126.09 | -4.12 | -3.16% |

At current rates, 3M expects $850 million of potential annualized impact of tariffs before exemptions, of which U.S. and China tariffs comprise $675 million, CFO Anurag Maheshwari said on a post-earnings call.

AMID STOCK SELL-OFFS, DON’T PANIC, EXPERTS SAY

3M also said it plans to leverage its network to mitigate the tariff costs.

“We ship products from the U.S. to China that we could also instead ship from Europe into China, and then perhaps backfill the volume in the U.S. toward the factories in Europe,” CEO Brown said on the call.

The industrial giant posted a first-quarter adjusted profit of $1.88 per share, higher than the average analyst estimate of $1.77, according to data compiled by LSEG.

It benefited from 2.5% growth in sales in its safety and industrial segment. Total net sales were $5.78 billion, above expectations of $5.75 billion.

Read the full article here