XRP (XRP) extended its downtrend on Feb. 28, down 9% in the last 24 hours to trade at $2.05.

What to know:

-

XRP trades in a third bearish session that has seen it lose a key support level at $2.20.

-

The global crypto market capitalization has also dropped 6.6% to $2.66 trillion at the time of publication.

XRP/USD four-hour price chart. Source: TradingView

-

Nearly $25.5 million worth of XRP futures positions have been liquidated over the last 24 hours, with long liquidations amounting to $22.2 million.

-

The SEC’s delay to drop Ripple’s case is adding uncertainty to the XRP market.

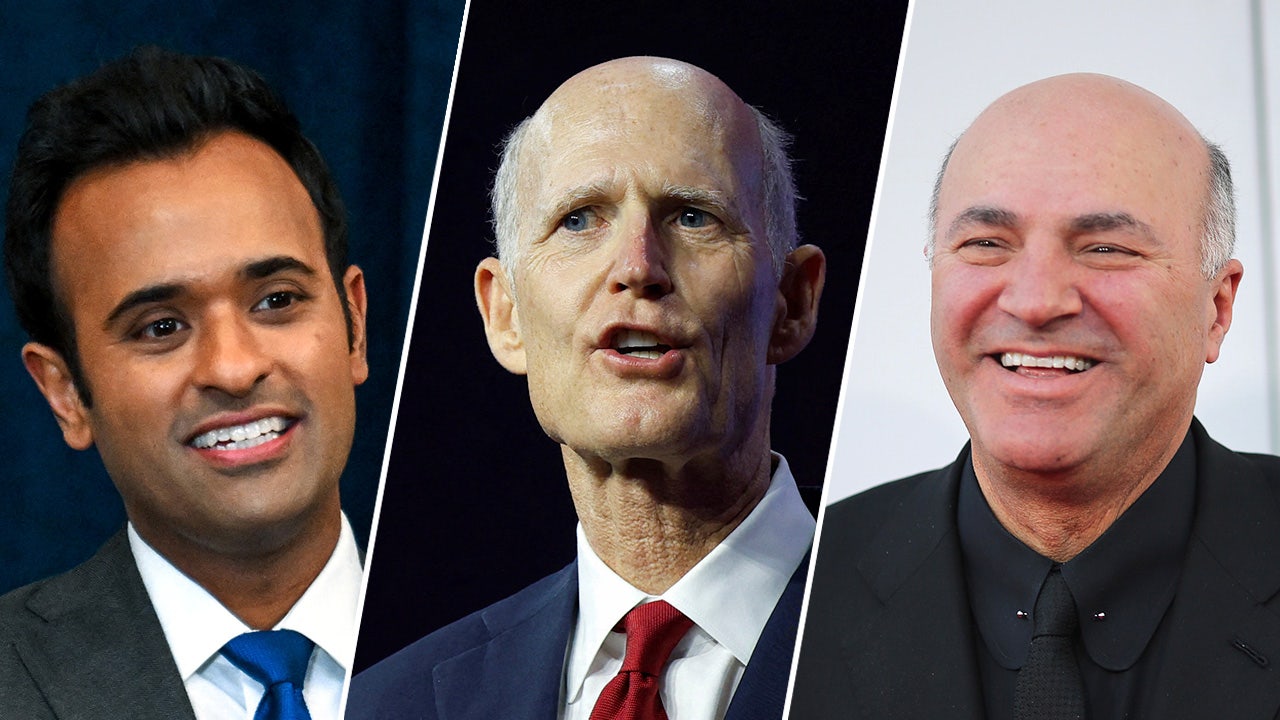

SEC delays dropping Ripple case

XRP has witnessed heavy losses since the beginning of the month, dropping nearly 35% as the Ripple community members remain hopeful that the US Securities and Exchange Commission (SEC) will drop its multi-year lawsuit against Ripple.

What to know:

-

Initiated in December 2020, the case saw a partial victory for Ripple in August 2024, when a federal judge fined the company $125 million—far less than the SEC’s $2 billion demand—for unregistered securities sales to institutional investors.

-

The ruling affirmed that XRP itself is not a security for retail sales.

-

However, the SEC appealed in October 2024, challenging this distinction.

-

Over the past week, the new SEC administration has scaled down its enforcement actions against crypto companies.

-

The agency has recently closed several legal cases, including those against Coinsase, Consensys, Robinhood, Uniswap, and Gemini.

🚨NEW: Enforcement investigations and actions brought by the @SECGov under @GenslerArchive are dropping like flies.@RobinhoodApp Monday@Uniswap Tuesday@Gemini Wednesday

Who Thursday?

Stay tuned. 📻 https://t.co/ePI04YNIbk

— Eleanor Terrett (@EleanorTerrett) February 26, 2025

Despite this, the new administration has not relented on Ripple, and the appeal filed by the SEC is still pending.

Related: XRP Ledger unveils institutional DeFi roadmap

The case, therefore, still casts a shadow over XRP’s price, adding fuel to the current headwinds.

Over $22 million in long XRP positions liquidated

XRP’s drop on Feb. 28 is accompanied by significant liquidations in the derivatives market, signaling strong bearish pressure.

Key points:

-

Over $22.30 million worth of long XRP positions have been liquidated over the last 24 hours, compared to $3.2 million in short liquidations.

-

Bullish traders are forced to sell their positions when long positions are liquidated.

Total XRP liquidations. Source: CoinGlass

-

The scale of these liquidations mirrors Feb. 3, when $74.5 million in long XRP positions were wiped out, accompanying a 36% drop in price from $2.78 to $1.76.

-

XRP’s open interest (OI) has also dropped 30% in the past seven days, signaling a decline in trader participation.

XRP futures open interest. Source: CoinGlass

-

Although the funding rate flipped positive on Feb. 27, it has dropped from 0.0079% to 0.0032% over the last 24 hours, suggesting a weaker bullish conviction.

XRP OI-weighted funding rate. Source: CoinGlass

XRP price needs to hold above $2.00

The drop in XRP price today is part of a correction that began on Jan. 16 after the relative strength index (RSI) painted massively overbought conditions following its run to seven-year highs at $3.40.

Key levels to watch:

-

XRP bulls are focused on defending the psychological support at $2.00, embraced by the lower boundary of the descending parallel channel.

-

XRP could extend the decline to the recent range low at $1.76 (formed on Feb. 3) and the psychological level at $1.50, where the 200-day SMA currently sits.

XRP/USD daily chart. Source: Cointelegraph/TradingView

-

On the upside, the relative strength index on the daily chart reads 29, indicating a potential recovery over the next few days.

-

The bullish case for the altcoin hinges on XRP price flipping $2.20 resistance into support.

-

A close above this level could pave the way for a sustained recovery toward $2.40.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here