Bitcoin (BTC) retreated from above $90,000 at the March 5 Wall Street open amid mixed signals over the US strategic reserve.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

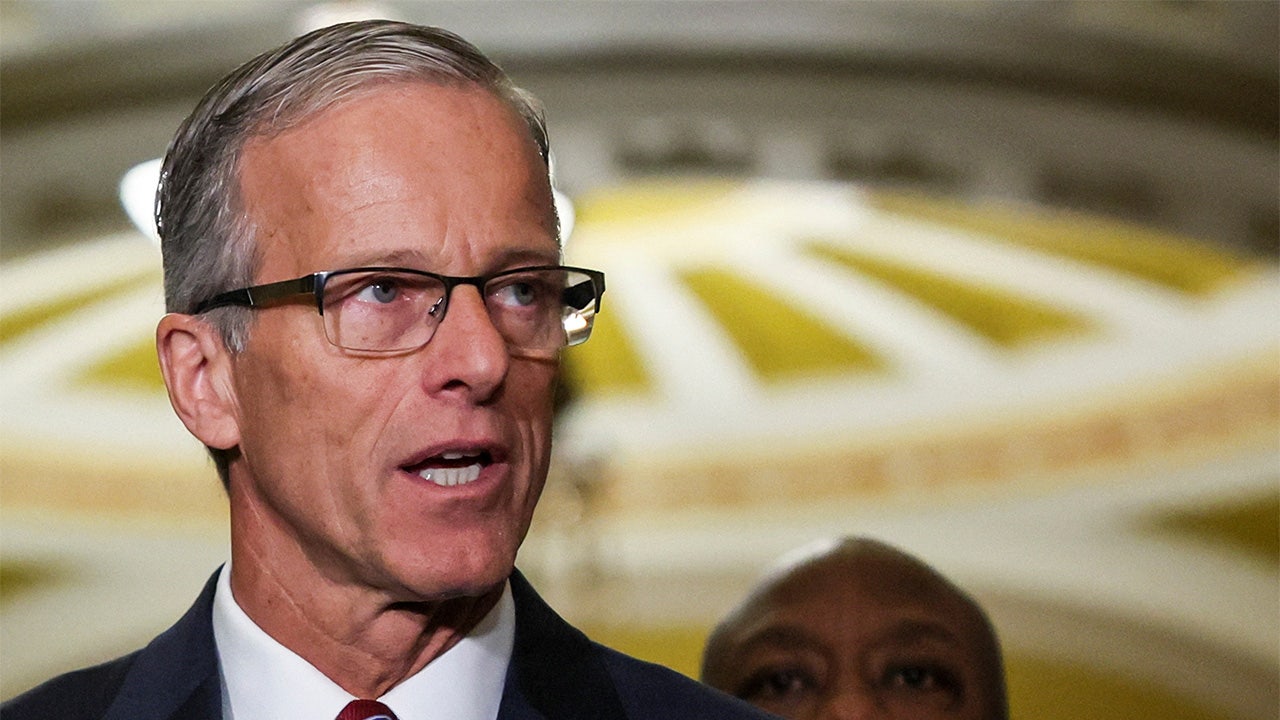

Senator: US Bitcoin reserve lacks support

Data from Cointelegraph Markets Pro and TradingView showed whipsaw BTC price action continuing as part of broader risk-asset volatility.

Geopolitical events maintained a firm grip on market performance, with stocks and crypto sensitive to developments over US trade tariffs and the reserve.

The latter appeared to get the green light earlier on the day as US Commerce Secretary Howard Lutnick implied that a separate Bitcoin-only stockpile would be announced at the White House Crypto Summit on March 7.

🇺🇸 LATEST: Commerce Secretary Howard Lutnick confirms the US Bitcoin Strategic Reserve is likely on the cards:

“A Bitcoin strategic reserve is something the President’s interested in… and I think you’re going to see it executed on Friday.” pic.twitter.com/B3JmmYDk6K

— Cointelegraph (@Cointelegraph) March 5, 2025

Thereafter, Wyoming Senator Cynthia Lummis, author of the Bitcoin reserve bill from 2024, acknowledged that there was a lack of Congressional support for the idea.

Proponents “might need to put a pin for a little while in the bitcoin strategic reserve because we’re not there yet,” paraphrasing Tim Scott, chairman of the House Banking Committee, quoted by mainstream media.

Lummis was speaking at the Bitcoin Investor Day event in New York.

Crypto market commentators nonetheless sought to preserve optimism on the concept, suggesting that it was a matter of “not ‘if,’ but ‘when.’”

“We are going to get a Strategic Bitcoin Reserve. There are too many smart people around the table for the United States to fumble this,” Professional Capital Management founder and CEO Anthony Pompliano, known as “Pomp,” argued in a post on X.

As Cointelegraph reported, various key industry figures have argued for a Bitcoin-only reserve to be the priority for the US government under President Donald Trump.

Bitcoin bulls “on borrowed time”

Summarizing the current trading environment, popular trader Jelle hoped for a resumption of upward momentum after an initial sell-off at the start of the US trading session.

Related: Bitcoin price metric that called 2020 bull run says $69K new bottom

“Yesterday – markets started pushing about 2 hours post-open. Let’s see,” he wrote in part of an X thread.

Trader and analyst Rekt Capital hoped that the March 4 dip to $82,000 would mark a “higher low” and form a foundation for an ongoing recovery.

Source: Rekt Capital

Zooming out, others were conflicted. Despite holding some of its gains, BTC/USD was likely in for a rematch with 15-week lows of $78,000, fellow trader Justin Bennett warned.

“I still think we see a sweep of the $78,260 low, especially after the rejection from $92k monthly resistance,” he told X followers on the day.

“Bulls are on borrowed time.”

BTC/USDT 1-day chart. Source: Justin Bennett/X

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here