Key takeaways:

-

The Bitcoin futures premium dropped to a 3-month low, even with prices just 8% below their all-time high.

-

BTC options metrics turned bearish, despite stock market resilience amid macroeconomic pressure.

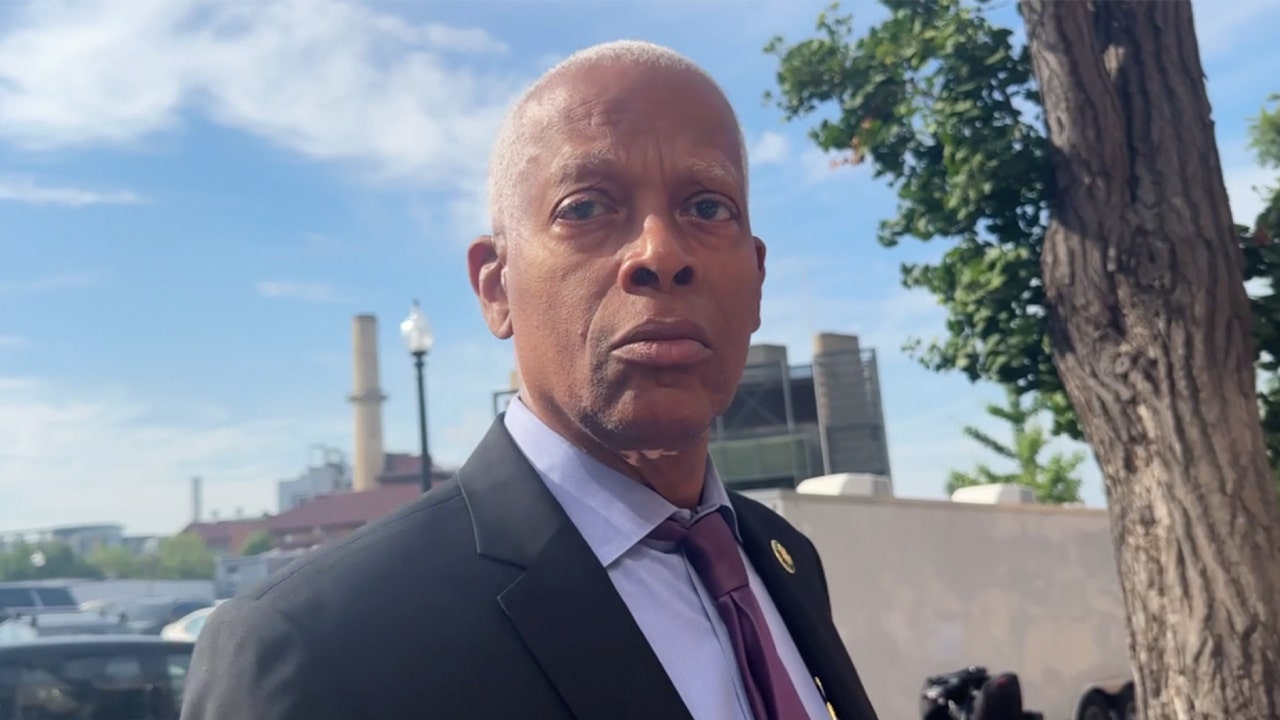

Bitcoin (BTC) derivatives metrics are flirting with bearishness despite BTC price trading just 8% below its all-time high at $103,300. Cryptocurrency traders are known for their short temper, especially those trading leveraged futures positions, but there is something unusual about the current lack of optimism.

Are deteriorating macroeconomic conditions behind BTC’s drop to $102,400?

Bitcoin derivatives’ weakness may be attributed to a specific factor within the industry, or it could be simply related to fear over the troubled socio-economic environment.

Under neutral conditions, monthly Bitcoin futures typically trade 5% to 15% above spot markets to compensate for the longer settlement period. This indicator has remained below the neutral threshold since June 12, following a rejection at the $110,000 level.

The metric has deteriorated compared to two weeks earlier, even though Bitcoin traded at $100,450 on June 5. The futures premium slipped below 4% on Thursday, marking the lowest level in three months. More surprisingly, the BTC futures metric is now lower than levels recorded in early April, when Bitcoin dropped 10% in 24 hours to $74,440.

To confirm whether the pessimism is limited to monthly futures contracts, one should assess Bitcoin options markets. When traders fear a price crash, put (sell) options gain a premium, pushing the skew metric above 5%. Conversely, during bullish periods, the indicator tends to move below -5%.

The Bitcoin options skew is currently at 5%, right at the edge of neutral to bearish sentiment. This stands in stark contrast to June 9, when the indicator briefly touched a bullish -5% level after Bitcoin jumped from $105,500 to $110,500. The shift highlights how traders are increasingly disappointed with Bitcoin’s recent performance.

The Russell 2000 US small-cap index held the 2,100 support level, even as tensions in the Middle East weighed on investor sentiment. Recession risks also increased, with interest rates remaining above 4.25% in the United States amid persistent inflationary pressure.

Related: Bitcoin rally to $120K possible if Fed eases rates due to tariff and war impact

Strong institutional appetite for Bitcoin contrasts with derivatives markets

Cryptocurrency traders are known for emotional swings, often selling in panic during uncertainty or showing excessive optimism in bull markets. The current weakness in Bitcoin derivatives suggests traders are not confident that the $100,000 support will hold.

Interestingly, institutional investor demand has remained strong during this period. US-listed Bitcoin spot exchange-traded funds (ETFs) recorded $5.14 billion in net inflows over the 30 days ending June 18. Additionally, firms such as Strategy, Metaplanet, H100 Group, and The Blockchain Group acquired significant quantities of BTC during that time.

It remains uncertain what might restore confidence among Bitcoin traders. However, the longer BTC price stays near the $100,000 psychological level, the more confident the bears will become.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Read the full article here