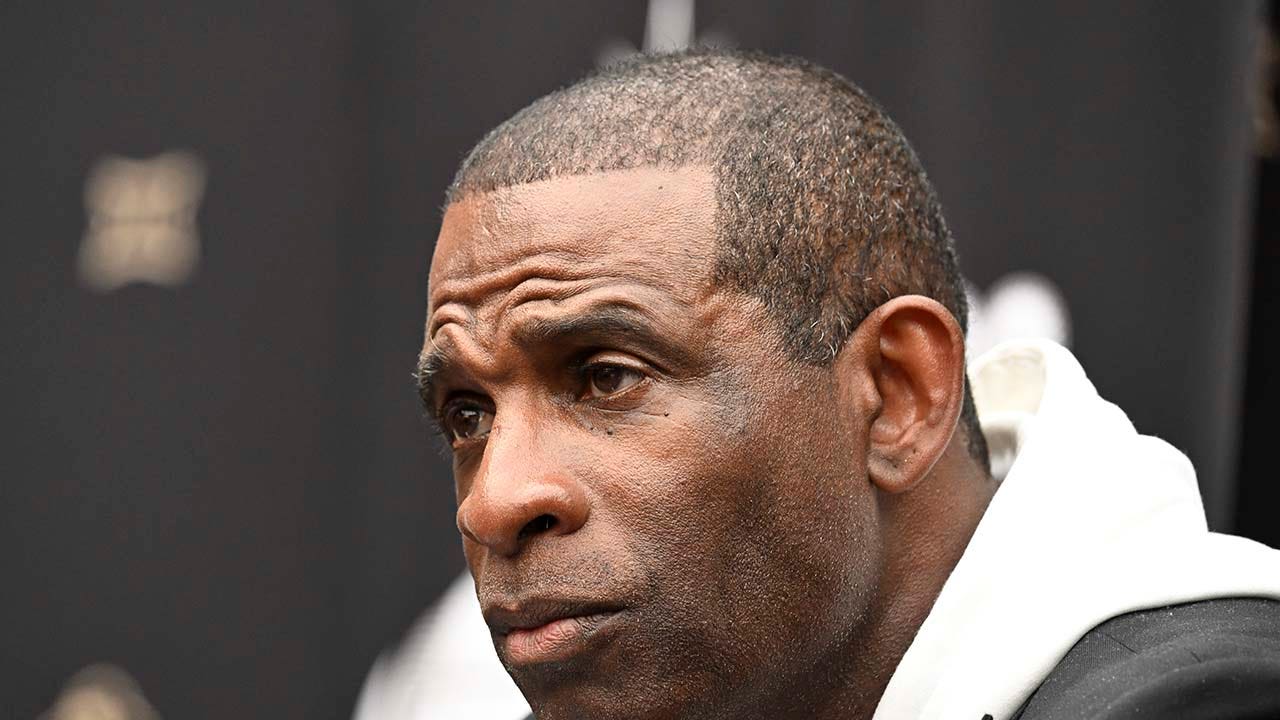

Investor and financial educator Robert Kiyosaki warned of the potential danger from holding paper Bitcoin (BTC) and precious metals through instruments such as exchange-traded funds (ETFs).

Kiyosaki said that although ETFs make certain asset classes more accessible to investors and lower the barrier to entry, the investor does not physically hold the underlying asset. He wrote on Friday:

“An ETF is like having a picture of a gun for personal defense. Sometimes it’s best to have real gold, silver, Bitcoin, and a gun. Know the differences when it is best to have real and when it’s best to have paper.”

In May, he told investors to ditch “fake money” for bearer assets like BTC, gold and silver to counteract the effects of inflation and the decline of the US dollar.

Kiyosaki’s comments reflect the age-old problem of financial institutions issuing paper claims on hard assets they purport to hold but may not actually have as liquid assets.

However, when confidence in the institution is shaken, whether due to rumors, a financial shock or evidence of insolvency, investors may rush to withdraw their money all at once. This sudden surge in withdrawals is known as bank run. If the institution lacks sufficient liquid reserves to meet these demands, it can quickly spiral into a crisis, potentially resulting in collapse.

Related: ‘Rich Dad, Poor Dad’ author warns Bitcoin ‘bubble’ could burst soon

ETFs have a long track record of integrity, concerns are unjustified, ETF analyst says

Senior Bloomberg ETF analyst Eric Balchunas told Cointelegraph that ETFs have some of the most robust security guarantees against this type of fraud due to the segregation between ETF issuers and custodians holding the underlying assets.

“ETFs legally have to put the assets in with the custodian. So, all the shares of the ETF are connected to actual Bitcoin; it’s a one-for-one ratio, there is no paper,” Balchunas said.

“I think in the crypto world, there’s a suspicion with the traditional finance world, and I understand that,” Balchunas told Cointelegraph. However, the ETF sector is a “30-year industry, and it’s a very clean industry with a sterling reputation,” he said.

Balchunas said ETFs may be a safer bet for wealthy Bitcoiners, as self-custody could make them targets of wrench attacks or ransom attempts perpetrated by violent criminals.

Magazine: Danger signs for Bitcoin as retail abandons it to institutions: Sky Wee

Read the full article here