NEWYou can now listen to Fox News articles!

President Donald Trump signs the sweeping Republican-crafted domestic policy package that he and the GOP call the “One Big Beautiful Bill,” into law on Friday at the White House.

The massive tax cuts and spending bill passed the House and Senate this week by razor-thin margins along near party lines.

But the political battle over the bill is far from over, as it moves from Capitol Hill to the campaign trail.

“I’m deeply concerned about this bill and what this will do. We’re going to be talking a lot about it,” Democratic Rep. Chris Pappas of New Hampshire told Fox News Digital on Friday.

GAME ON: REPUBLICANS, DEMOCRATS, TRADE FIRE OVER BIG, BEAUTIFUL BILL

Pappas, who’s running in the crucial 2026 race to succeed retiring longtime Sen. Jeanne Shaheen for a Democrat-held seat Republicans would love to flip, took aim at the bill.

“This was a one-party effort and unfortunately it arrived at a conclusion that I think is not good for our state and for our country,”

TRUMP TOUTS ‘BIG BEAUTIFUL BILL’ IS ‘VERY POPULAR’ DESPITE POLLING

Former Republican Sen. Scott Brown, who last month announced his candidacy for the Senate, sees things differently, and he praised the president for helping GOP leaders in Congress get the bill to his desk at the White House.

“The things he said he was going to do, he’s actually done. For somebody in politics to actually do that I think is very rare,” Brown said of Trump.

The bill is stuffed full of Trump’s 2024 campaign trail promises and second-term priorities on tax cuts, immigration, defense, energy and the debt limit.

It includes extending his signature 2017 tax cuts and eliminating taxes on tips and overtime pay.

By making his first-term tax rates permanent – they were set to expire later this year – the bill will cut taxes by nearly $4.4 trillion over the next decade, according to analysis by the Congressional Budget Office and the Committee for a Responsible Federal Budget.

‘BIG BEAUTIFUL BILL ON WAY TO WHITE HOUSE AFTER NARROWLY PASSING FINAL HURDLE IN CONGRESS

The measure also provides billions for border security and codifies the president’s controversial immigration crackdown.

And the bill also restructures Medicaid — the nearly 60-year-old federal program that provides health coverage to roughly 71 million low-income Americans. Additionally, Senate Republicans increased cuts to Medicaid over what the House initially passed in late May.

The changes to Medicaid, as well as cuts to food stamps, another one of the nation’s major safety net programs, were drafted in part as an offset to pay for extending Trump’s tax cuts. The measure includes a slew of new rules and regulations, including work requirements for many of those seeking Medicaid coverage.

And the $3.4 trillion legislative package is also projected to surge the national debt by $4 trillion over the next decade.

Democrats for a couple of months have blasted Republicans over the social safety net changes.

“We’re going to be talking about this bill because the results are that 46,000 people in New Hampshire will lose their health insurance. We’ll have people that will go hungry, that won’t be able to access assistance,” Pappas warned. “And we know that insurance premiums for all Granite Staters could go up as a result of uncompensated care costs and the burden that this places on our hospitals.”

The four-term congressman, who was interviewed by Fox News on Friday as he arrived for the annual July 4th naturalization ceremony in Portsmouth, New Hampshire, noted that “we’ve been hearing from folks and engaging with people all across the state on this issue.”

Democrats have spotlighted a slew of national polls conducted last month that indicate the bill’s popularity in negative territory.

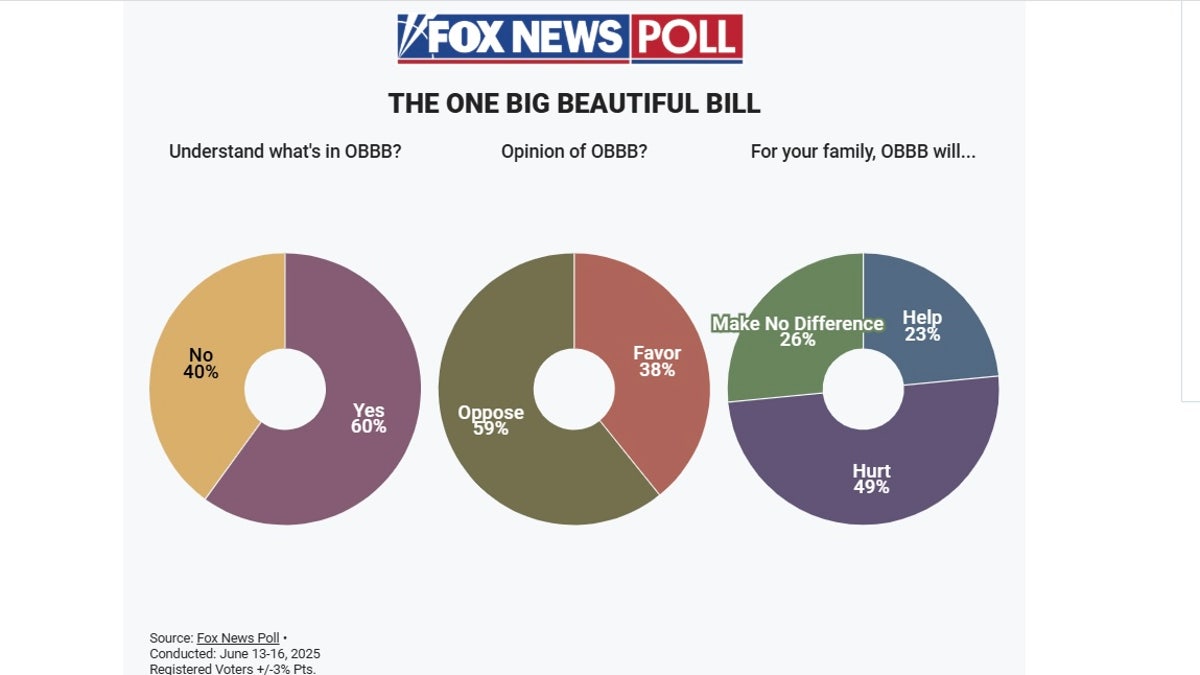

By a 21-point margin, voters questioned in the most recent Fox News national poll opposed the bill (38% favored vs. 59% opposed).

HEAD HERE FOR THE LATEST FOX NEWS POLLING

The bill was also underwater in other national surveys conducted last month by the Washington Post (minus 19 points), Pew Research (minus 20 points) and Quinnipiac University (minus 26 points).

About half of respondents questioned in the Fox News poll said the bill would hurt their family (49%), while one quarter thought it would help (23%), and another quarter didn’t think it would make a difference (26%).

Asked about criticism from Democrats on the Medicaid cuts, Brown said “my mom was on welfare. Those are very important programs and I’ve said already that the people that actually need them the most, the ones who are disabled, the ones who can’t get out and work, they should have them.”

“It’s meant for lower and middle-income people and I support them getting those benefits. But I don’t support who are here illegally get them,” Brown said.

And he added that he doesn’t support giving the benefits to “people who are able-bodied and can absolutely go out and do some volunteerism, go out and work.”

WHAT’S ACTUALLY IN TRUMP’S ‘BIG BEAUTIFUL BILL’

Republicans are also going on offense over the bill, targeting Democrats for voting against the tax cuts.

Republicans are shining a spotlight on recent polls conducted by GOP-aligned groups that indicate strong support for the bill due to the tax cut provisions.

Brown, who was interviewed by Fox News after he marched in the annual Brentwood, New Hampshire July 4th parade, said “obviously keeping the 2017 tax cuts in place. Certainly for individuals and businesses, it’s really really critical.”

And pointing to Pappas, whose family for over a century has owned Manchester’s iconic Puritan Backroom restaurant, Brown said “for someone like Chris Pappas, imagine walking into the restaurant he owns and telling his employees ‘oh by the way I’m not going to support your no tax on tips, your no tax on overtime.’ How do you do that?”

Asked about the GOP attacks, Pappas said “I support targeted tax cuts for working people, for our small businesses and to make sure we are targeting that relief to the people that need it, not to billionaires, to the biggest corporations in way that adds $4 trillion to the national debt as this bill does.”

“We hoped there would be an opportunity for a bipartisan conversation on taxes and how we can invest in the middle class and working people and our small businesses and unfortunately that didn’t happen,” he added.

Read the full article here