Key takeaways:

-

Bitwise forecasts Bitcoin price to reach $1.3 million by 2035, projecting 28.3% annualized returns that outpace traditional assets.

-

Institutional investors dominate Bitcoin demand, with corporate holdings surging and Strategy leading in accumulation.

-

Limited supply, strong hodling, and macroeconomic pressures create a setup for long-term Bitcoin price growth.

Crypto asset management firm Bitwise released new projections for Bitcoin (BTC), forecasting a price target of $1.3 million by 2035, driven by institutional demand and Bitcoin’s limited supply.

The report published as part of Bitwise’s ‘Long-Term Capital Market Assumptions’ for Bitcoin projects a 28.3% compound annual growth rate (CAGR) over the next decade, significantly outpacing traditional assets like equities (6.2%), bonds (4.0%), and gold (3.8%).

While Bitwise’s base case projects $1.3 million by 2035, the firm provides multiple scenarios. In a bullish case, Bitcoin could reach $2.97 million (39.4% CAGR), while a bearish scenario suggests potential downside to $88,005 (2% CAGR).

The wide range reflects the inherent volatility still expected in Bitcoin markets despite increasing institutional participation.

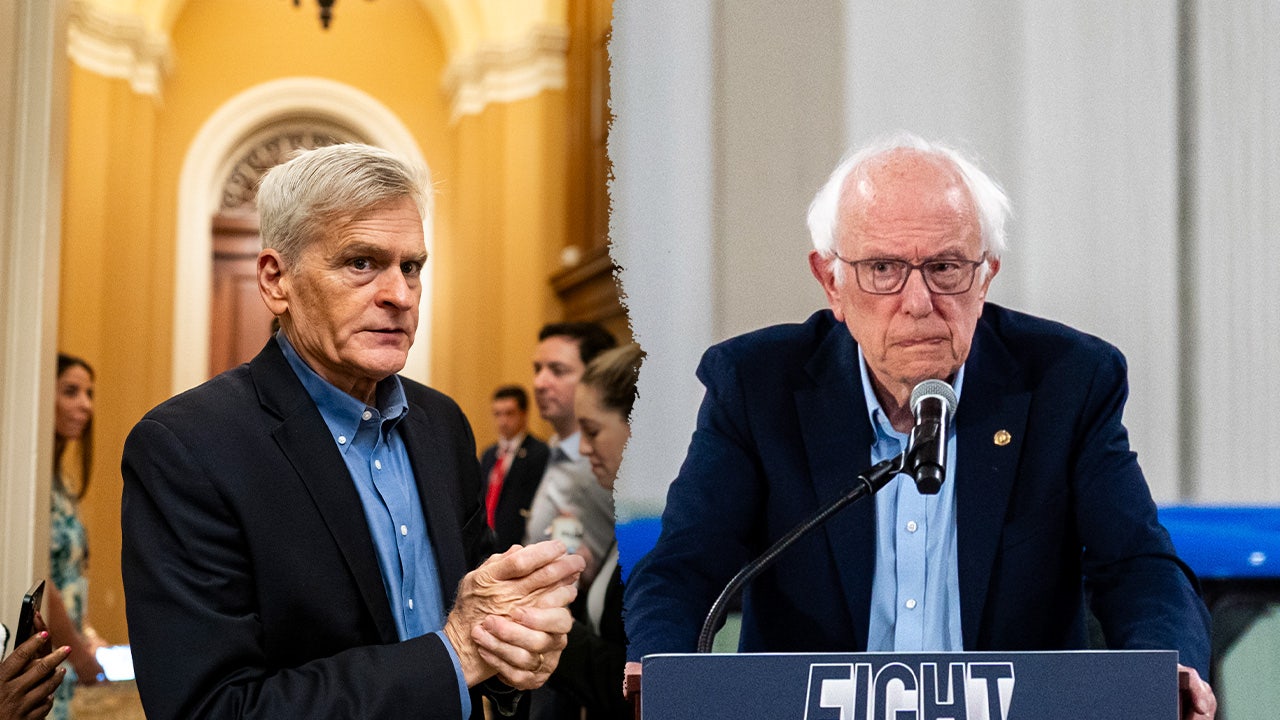

Chief investment officer Matt Hougan, alongside analyst Ryan Rasmussen, Josh Carlisle, Mallika Kolar, Andre Dragosch, and strategist Juan Leon, reveals that Bitcoin is no longer a retail-driven market, with institutional flows now dominating price action.

Cointelegraph recently reported that over 75% of Bitcoin trading volume on Coinbase comes from institutional investors, a level historically associated with major price movements. This level of participation has reached an intensity that demand currently exceeds daily mining production by up to six times, creating significant supply-demand imbalances.

The change in dynamics is also evident in recent market developments. Corporate Bitcoin adoption has accelerated dramatically, with 35 publicly traded companies now holding at least 1,000 BTC each, up from 24 companies at the end of Q1 2025. Total corporate Bitcoin purchases increased 35% quarter-over-quarter in Q2 2025, rising from 99,857 BTC to 134,456 BTC.

MicroStrategy continues leading corporate accumulation, signaling its fourth monthly Bitcoin purchase on Aug. 25, bringing total holdings to over 632,457 BTC valued at more than $71 billion. The company represents over 53% unrealized gains on its Bitcoin investment, totaling $25 billion in unrealized profits.

Related: Bitcoin megaphone pattern targets $260K as BTC price screams ‘oversold’

Bitcoin supply scarcity, macroeconomic tailwinds create a perfect storm

With 94.8% of the total BTC supply already in circulation and annual issuance dropping to 0.2% by 2032 from 0.8%, Bitwise outlines that new Bitcoin production cannot meet rising institutional demand. Unlike traditional commodities, Bitcoin’s supply cannot be increased regardless of price appreciation.

Bitwise emphasizes that “the inelastic supply of Bitcoin, combined with continued demand growth, is the single most important driver of our long-term assumptions.”

This scarcity is compounded by approximately 70% of Bitcoin supply remaining unmoved for at least one year, indicating strong hodling behavior among existing holders.

Rising concerns about fiat currency debasement provide additional support for Bitcoin adoption. US federal debt has increased by $13 trillion over five years to $36.2 trillion, with annual interest payments reaching $952 billion, the fourth-largest federal budget item. As interest rates exceed expected GDP growth, pressure on traditional currencies intensifies.

The convergence of limited supply, accelerating institutional adoption, and macroeconomic uncertainty creates what analysts describe as a “perfect storm” for Bitcoin price appreciation.

With miners producing only 450 BTC daily while institutions withdraw over 2,500 BTC in 48-hour periods, the supply-demand imbalance appears positioned to drive significant price discovery over the coming decade.

Related: Bitcoin trend reversal to $118K or another drop to $105K: Which comes first?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here