Gold price today: Gold rates fluctuated between gains and losses in the domestic futures market Wednesday morning amid rising US dollar and bond yields. However, MCX Gold for December 5 expiry jumped to hit its fresh record high of ₹78,755 per 10 grams. It traded at this level around 10:10 am.

Uncertainty surrounding the US election 2024 and the outlook on interest rate cuts by the US Fed boosted the US dollar to an over two-month high while treasury yields jumped to the highest level since July, weighing on bullion.

Gold is priced in US dollars globally. When the dollar strengthens, gold becomes more expensive in other currencies, reducing their demand and leading to a drop in gold prices.

Similarly, rising yields on government bonds lead to a decline in gold prices. This is because gold does not pay interest or dividends, making it less attractive when bond yields rise. Investors usually shift funds from gold to bonds when bond yields increase to earn a guaranteed return.

Gold prices have seen remarkable returns this year due to geopolitical uncertainty, expectations of rate cuts, a largely stable dollar index, and aggressive central bank buying.

Experts remain optimistic about the prospects of the yellow metal due to persisting geopolitical uncertainty and the US Fed rate cuts.

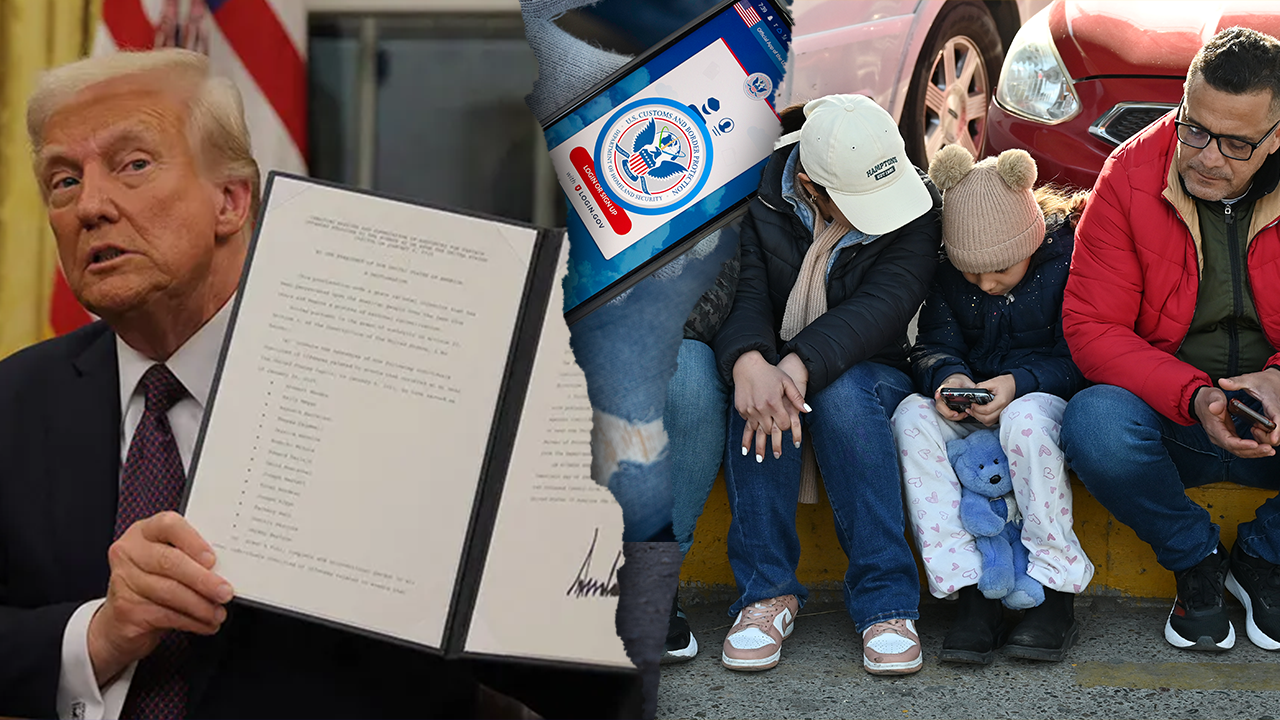

The upcoming US election is a key factor that will significantly affect gold prices. Former President Donald Trump’s victory could lead to fiscal policy changes, tariff implementations, and shifts in monetary policy, creating market volatility.

“Uncertainty surrounding the upcoming US presidential elections, coupled with the BRICS nations’ push towards de-dollarisation, is driving demand for precious metals. With the elections just around the corner, the growing unpredictability over Kamala Harris’s prospects is further fuelling the safe-haven appeal of gold and silver,” said Rahul Kalantri, the VP of commodities at Mehta Equities.

Experts’ strategy for MCX Gold

According to Kalantri, gold has support at $2,717-$2,690 and resistance at $2,755-$2,768, while silver has support at $34.12-$34.30, with resistance at $34.72-$34.90. In INR terms, gold has support at ₹78,380- ₹78,140 and resistance at ₹78,950- ₹79,150. Silver’s support lies at ₹99,140- ₹98,350, with resistance at ₹1,01,000- ₹1,01,780.

Manoj Kumar Jain of Prithvifinmart Commodity Research said gold has support at $2,744-2,722, while resistance at $2,774-2,788 per troy ounce and silver has support at $34.40-34.00, while resistance is at $35.50-36.00 per troy ounce in today’s session.

On the MCX, Jain said gold has support at ₹78,400-78,100 and resistance at ₹78,850-79,140, while silver has support at ₹99,000-97,700 and resistance at ₹1,01,000-1,02,400.

“We suggest booking profits in gold and silver and waiting for corrective dips to initiate fresh long positions. The overall bullish trend of gold and silver is intact,” said Jain.

Disclaimer: The views and recommendations above are those of individual analysts, experts, and brokerage firms, not Mint. We advise investors to consult certified experts before making any investment decisions.