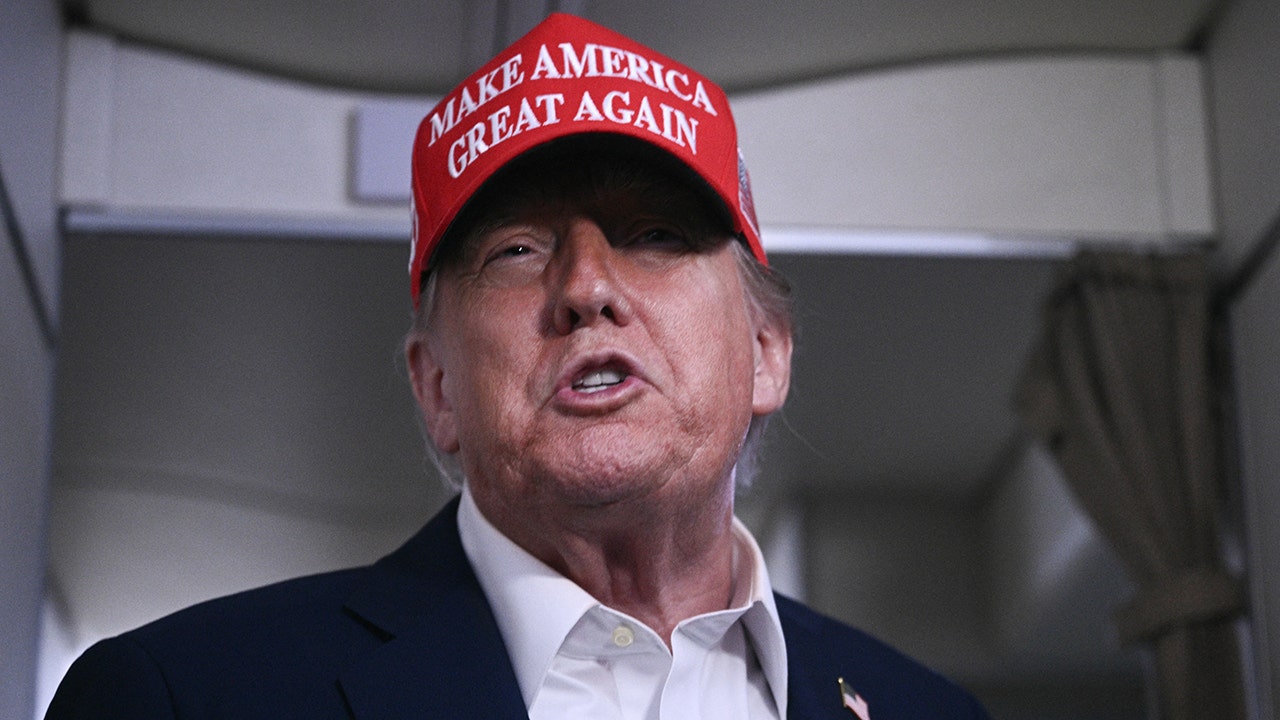

The One Big Beautiful Bill Act, recently signed into law by President Donald Trump, allows millions of babies born in the U.S. to receive a $1,000 “Trump Account.”

These accounts, which are created by the government for those under 18 years old, are designed to help young people start investing early.

“This will afford a generation of children the chance to experience the miracle of compounded growth and set them on a course for prosperity from the very beginning,” the White House said.

AMERICAN HOMEOWNERS AND FAMILIES GET RELIEF WITH THE ‘ONE, BIG BEAUTIFUL BILL’

Children born between Jan. 1, 2025 and Dec. 31, 2028 are eligible for a one-time $1,000 payment into their Trump Accounts, courtesy of the federal government.

Parents and relatives can contribute up to $5,000 each year into the account until the child turns 18 years old. After 2027, the $5,000 number may be adjusted for inflation.

‘BIG, BEAUTIFUL BILL’ INCLUDES TAX BREAKS FOR TIPS AND OVERTIME: WHO BENEFITS?

Parents’ employers can also contribute, according to the bill.

The child can access the money, which must be invested in low-cost stock mutual funds or exchange-traded funds like the S&P 500, once they turn 18 years old.

A Social Security number is required to open an account, and only one account can be opened per child, according to the new law.

“This initiative gets at the core of binding those future generations to the benefits and the potential of America’s great companies and markets,” Goldman Sachs CEO David Solomon said in a statement. “Early childhood investments have far-reaching benefits, and Goldman Sachs is proud to support his initiative … Our economy’s future vitality is dependent on young people understanding the power of investing for the long term.”

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GS | THE GOLDMAN SACHS GROUP INC. | 708.26 | +2.42 | +0.34% |

THE ‘BIG, BEAUTIFUL BILL’ REVERSES BIDEN-ERA POLICIES TO BOOST AMERICAN ENERGY DEVELOPMENT AND PRODUCTION

Trump signed the bill into law on July 4.

The bill includes key provisions that would permanently establish individual and business tax breaks included in Trump’s 2017 Tax Cuts and Jobs Act, and incorporates new tax deductions to cut duties on tips and overtime pay.

Before signing the bill, the president said it would “fuel massive economic growth” and “lift up the hard-working citizens who make this country run.”

The White House did not immediately respond to FOX Business’ request for comment.

Fox News Digital’s Diana Stancy and Alexandra Koch contributed to this report.

Read the full article here