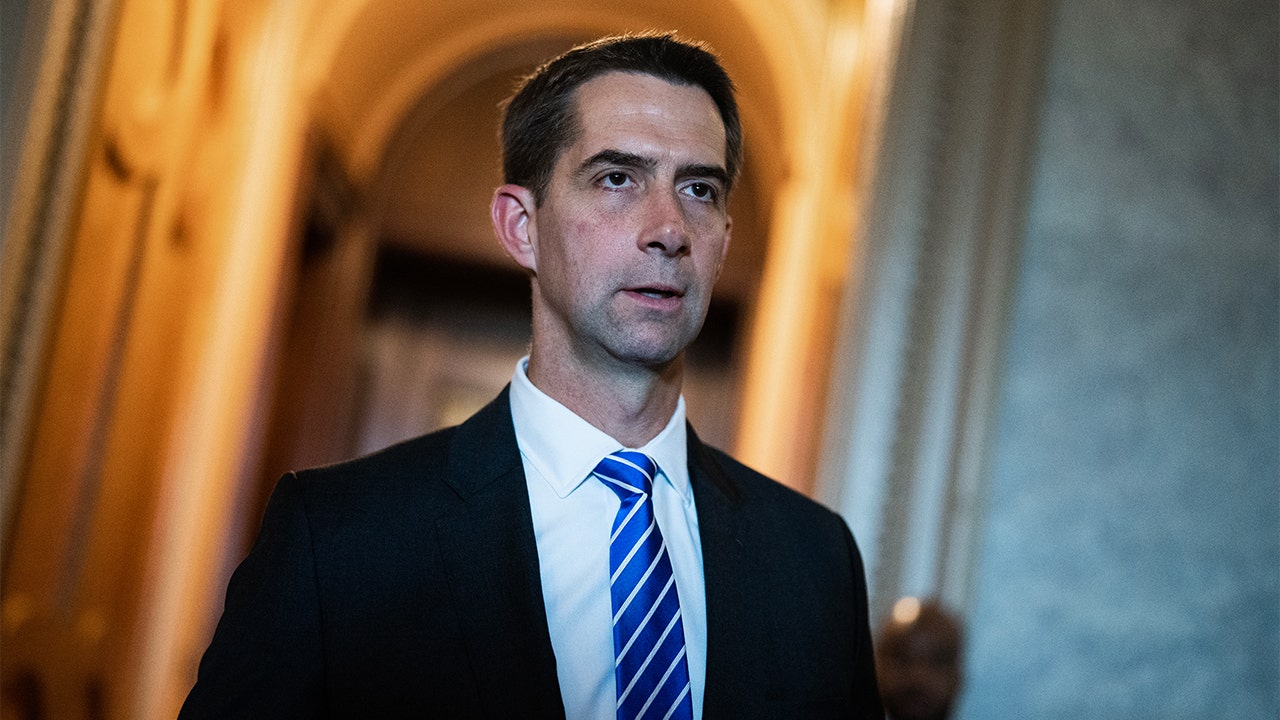

The number of public companies holding Bitcoin rose 38% between July and September, in a sign that “large players are doubling down, not backing away” from Bitcoin, according to analysts.

Crypto asset manager Bitwise found in its Q3 Corporate Bitcoin Adoption report, citing data from BitcoinTreasuries.NET, that 172 companies now hold Bitcoin (BTC), with 48 new ones entering the digital asset treasury space during the quarter.

Bitwise CEO Hunter Horsley said in an X post on Tuesday that the figures are “absolutely remarkable,” and show that “People want to own Bitcoin. Companies do too.”

Bitwise’s report also found that the value of the total holdings among all the companies has risen to $117 billion, up over 28% quarter over quarter. The total number of coins held has also crossed over one million, representing 4.87% of the total supply.

Large corporations still want BTC

Speaking to Cointelegraph, Rachael Lucas, an analyst at Australian cryptocurrency exchange BTC Markets, said the growing accumulation suggests “larger players are doubling down, not backing away.”

The largest Bitcoin treasury company by far is Michael Saylor’s Strategy, with its most recent buy on Oct. 6; now holding 640,250 tokens. Meanwhile, crypto miner MARA Holdings is the second-largest with 53,250 Bitcoin, after its holdings increased on Monday.

“As more corporations and even sovereigns step in, we expect this momentum to continue, especially as regulatory clarity improves and the infrastructure supporting institutional crypto adoption matures,” Lucas added.

At the same time, Lucas thinks it’s a clear signal that “institutional adoption is deepening,” because “they’re not just chasing short-term gains, they’re making a long-term decision on digital assets as part of their treasury strategy.”

“This participation helps legitimize crypto as a mainstream asset class and lays the foundation for broader financial innovation, from Bitcoin-backed loans to new derivatives markets.”

Supply is being sucked up, so when’s the bull run?

Despite the steadily increasing accumulation, the price of Bitcoin has been volatile as of late. Lucas said that corporations typically buy Bitcoin over-the-counter, a “quieter form of accumulation that avoids slippage and volatility,” but also means they don’t immediately impact the spot market price.

However, she also said that while institutions are buying, other forces can sometimes be at play and cause “sharp corrections,” such as long-term holders taking profits, increased derivatives activity, and macroeconomic shocks, like the recent US-China trade tensions.

Meanwhile, Edward Carroll, head of markets at blockchain investment company MHC Digital Group, told Cointelegraph that while Bitcoin treasury accumulation is still in its early stages, the “surge in institutional interest” will likely cause a demand and supply imbalance, “which should firmly place upward pressure on price action in the medium-long term.”

As a result, Carroll thinks demand for Bitcoin will be “ordered and increasing over the coming years,” and he expects it to “decouple from a correlation to risk/sentiment as institutional demand picks up.”

Related: Crypto treasury share buybacks could signal a ‘credibility race’ is on

On average, miners generate roughly 900 Bitcoin per day, according to Bitbo. A report from the financial services company River, released in September, found that businesses are acquiring 1,755 Bitcoin on average per day in 2025.

Crypto becoming mature

Beyond corporate crypto buys, Bitcoin exchange-traded funds are also on the rise, which, according to Lucas, is opening the door for more traditional investors to gain exposure to digital assets through familiar, regulated vehicles, marking a “significant shift and a major step toward mainstream adoption.”

Last week, US spot Bitcoin ETFs continued their strong “Uptober” performance with $2.71 billion in weekly inflows.

“What we’re witnessing is a maturing market. Crypto is evolving from a speculative playground into a legitimate asset class with institutional-grade participation.”

Magazine: ‘Debasement trade’ will pump Bitcoin, Ethereum DATs will win: Hodler’s Digest, Oct. 5 – 11

Read the full article here