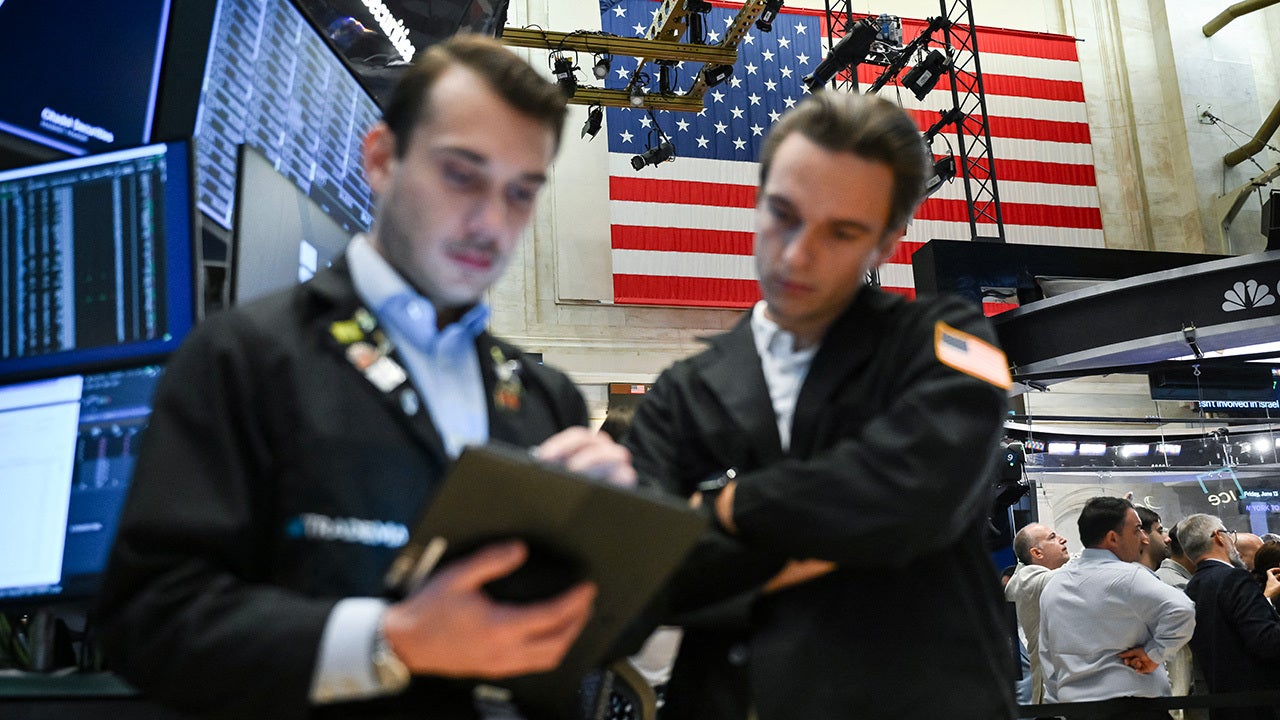

As President Donald Trump ramps up his trade war rhetoric, Wall Street remains largely unfazed, with investors viewing it more as political posturing than actual policy.

So far this week, Trump has sent letters to 20 countries threatening new tariff rates and pressuring global leaders to manufacture goods in the U.S. Trump’s trade negotiations – a hallmark of his economic agenda during his first administration – have recently been met with loud yawns from Wall Street.

A BREAKDOWN OF THE TRADE LINKS OF TRUMP’S LATEST TARIFF TARGETS

The S&P 500 climbed higher on Wednesday, largely led by tech giants Nvidia, Microsoft and Alphabet. Meanwhile, the Dow Jones Industrial Average climbed more than 200 points, or up 0.6%, while the S&P 500 and Nasdaq Composite rose 0.5% and 0.8%, respectively.

Earlier in the week, Trump said in a Truth Social post that “no extensions will be granted” to countries after the Aug. 1 deadline. Analysts at ING were not convinced the president would stick to the new target date.

“Even though Donald Trump’s letters suggest a take-it-or-leave-it offer, the reality is that they have effectively extended the tariff deadline from 9 July to 1 August,” ING analysts wrote in a note. The note described Trump’s ambitious “90 deals in 90 days” goal as “unsurprisingly, unrealistic.”

TRADERS BET AGAINST RECESSION AS TRUMP’S ECONOMIC POLICIES CONTINUE TO SHOW REMARKABLE STRENGTH

Paul Donovan, chief economist at UBS Global Wealth Management, called tracking Trump’s trade updates on social media “a wasted effort.”

“It seems a wasted effort to analyze every Trump social media post when investors understandably anticipate future retreats,” Donovan wrote in a research note. “Trump is expected to announce more U.S. consumer taxes today. The minutes of the last Federal Reserve meeting are likely to articulate a collective shrug of the shoulders.”

TRUMP ANNOUNCES HIGHER TARIFF RATES FOR MORE COUNTRIES IN SOCIAL MEDIA LETTERS

Goldman Sachs echoed similar sentiments, writing “we do not generally expect these proposed rates to take effect on Aug. 1.”

The majority of the new tariffs announced closely reflect the rates proposed in April; Laos and Burma are set to face the highest levy at 40%. Meanwhile, goods from Cambodia and Thailand will face slightly lower rates of 36%. Additionally, Brunei, Japan, Kazakhstan, Malaysia, Moldova, South Korea and Tunisia will see a 25% tariff hike.

The Philippines has so far received the lowest tariff rate at 20%.

CLICK HERE TO GET FOX BUSINESS ON THE GO

Read the full article here